User Research

Competitive Analysis, User Interviews

UX Design

Sketching, Low & high fidelity wireframes, Interaction Design, Prototyping, Usability Testing

Product Management

Project Coordination, Requirements Gathering, Stakeholder Communication, Sprint Planning, Cross-Functional Collaboration, Prioritizing Features, Quality Assurance

The solution focused on enhancing the customer experience by addressing key challenges in traditional banking processes. Leveraging user research methods, we identified critical pain points that customers encountered while accessing services at physical branches. This research became the foundation for developing a solution tailored to meet the most frequently sought services.

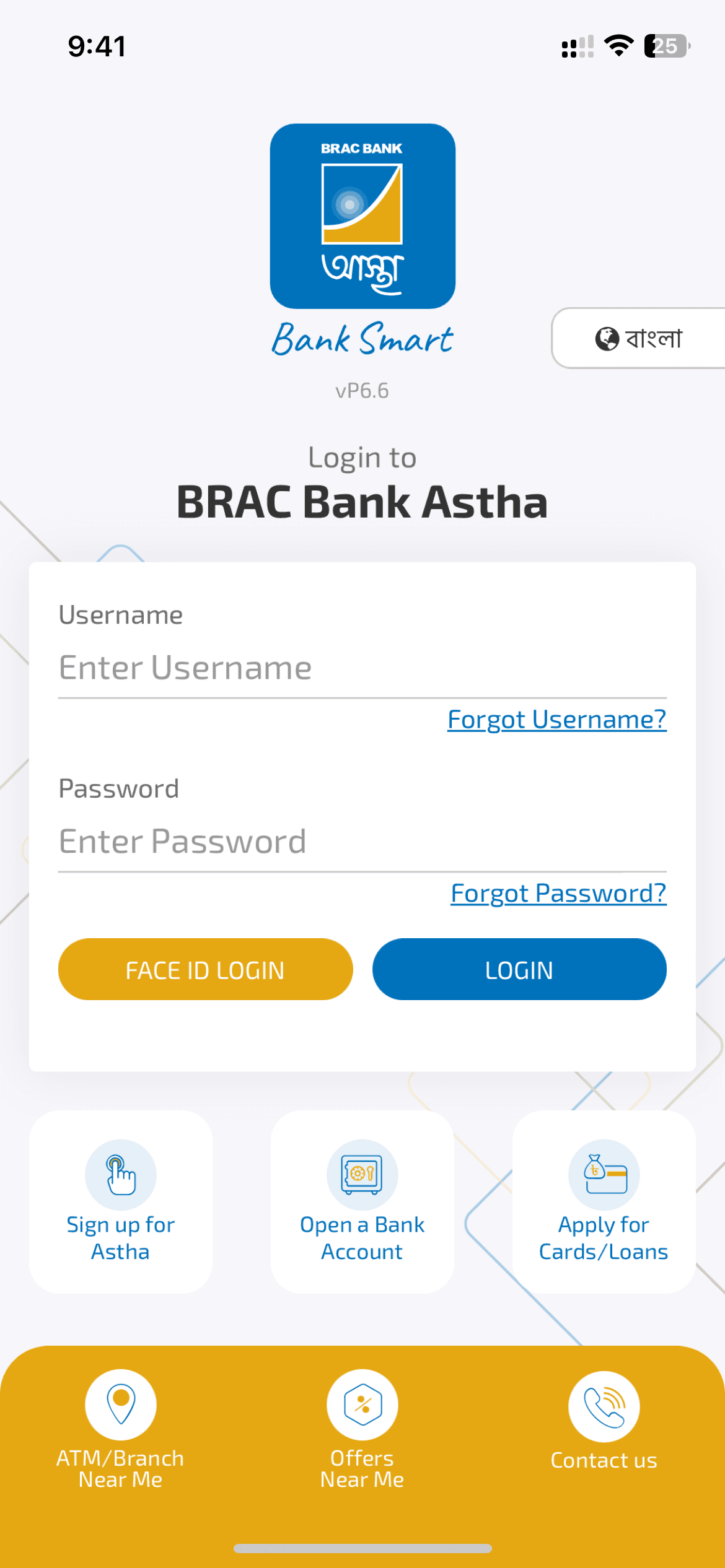

Astha Sheba

Astha Sheba revolutionized customer service by enabling users to access high-value services and lodge complaints directly through the app, eliminating the need to rely on traditional touchpoints such as branch visits, customer care centers, or email correspondence with the service team. This feature empowers users with real-time tracking of service requests and complaint statuses within the app, offering unparalleled transparency. Additionally, it provides an estimated resolution time, enabling users to anticipate outcomes without the hassle of contacting the bank’s support channels.

Planning & Research

During the initial brainstorming sessions with cross-functional stakeholders, we explored the idea of incorporating high-value services as individual features within the Astha app. However, the internal tech team highlighted that such an approach would require extensive development efforts, significantly increasing both time and cost, as the application development team was outsourced.

To address these challenges, I proposed integrating the At Your Service (AYS) platform with Astha during a team meeting and outlined the numerous benefits of this approach. The AYS platform, already utilized by our operations team, managed over 500 unique service requests and processed more than 200 complaint requests originating from various touchpoints, including branches, customer care centers, and emails.

This integration would enable Astha app to access all the service requests and complaint issues eliminating the need to develop each service from scratch within the app. I emphasized that this solution would save significant development hours, reduce costs substantially, and provide the flexibility to introduce new service requests efficiently.

By creating these requests within the AYS platform, they could be seamlessly accessed through the Astha app by simply developing the front-end.

Design & Prototyping

Following approval from senior management, we initiated collaborative ideation sessions, establishing a focus group comprising relevant cross-functional teams to map out comprehensive end-to-end user flows. This approach ensured alignment with business objectives while addressing user needs.

To bring our ideas to life, we began by crafting quick sketches and low-fidelity wireframes, allowing us to visualize and iterate on core concepts efficiently. These wireframes served as a blueprint for discussions, enabling stakeholders to provide early feedback and refine the design. Upon obtaining approval, we transitioned to high-fidelity prototypes, transforming the wireframes into polished, interactive interfaces that reflected the intended user experience and functionality. To ensure the design met the expectations of diverse user groups, we assembled a focus group of representatives from various departments. Their feedback was instrumental in validating the usability, aesthetics, and technical feasibility of the design.

Testing & Optimization

We transitioned to the testing phase after finalizing the design to ensure the solution was fully optimized. The first phase, conducted in the User Acceptance Testing (UAT) environment, involved extensive validation on multiple devices. This step allowed us to uncover and address critical issues such as UX inconsistencies, API integration errors, and system bugs, ensuring compatibility and performance across platforms.

We executed a comprehensive suite of test cases to evaluate core aspects such as functionality, usability, and system responsiveness under real-world conditions. Once all issues were resolved and the UAT environment met the defined requirements, we advanced to the pre-production environment. This intermediate stage provided an additional layer of testing to simulate production-like conditions, ensuring the system was fully prepared for deployment to the live production server. This iterative approach to testing was key to delivering a reliable, seamless, and high-performing solution.

Deployment

The product was first rolled out internally to BRAC Bank employees, initially offering 25 key service requests. This controlled release allowed us to monitor system performance, identify potential issues, and gather early feedback over a week-long observation period to ensure the platform was optimized for a broader audience.

Coordination was essential during this phase, requiring alignment with relevant operations teams associated with the AYS Platform because existing AYS user flow needed adjustment. Simultaneously, we worked with the brand team to strategize and execute a promotional campaign aimed at creating widespread awareness. The goal was to showcase the feature’s capabilities to both existing customers and potential new customers, leveraging the promotion to drive adoption and highlight the convenience of the Astha app.

The launch of the Astha Sheba marked a significant milestone in redefining digital banking solution for BRAC Bank customers. Within the first three months of the public rollout, the app experienced a 35% increase in active users, with over 40% of service requests being routed through the app, significantly reducing dependency on traditional touchpoints such as branches and call centers. Customer were empowered with real-time updates and transparency, leading to a 25% improvement in Net Promoter Score (NPS) for service delivery. The marketing campaign played a pivotal role in driving adoption, with the app gaining 10,000+ new users and reinforcing BRAC Bank’s position as a leader in digital innovation.

By leveraging customer feedback, competitor analysis and continuous introduction of new services Astha app now stands as a benchmark for secure, smart, and customer-centric digital banking solution.

Beyond Astha Sheba, below features were developed to address specific customer needs, ensuring greater convenience and efficiency in everyday banking.

Cheque Book Management

This feature streamlines cheque-related operations, allowing users to activate newly issued cheque books seamlessly through the app. It also introduces an advanced cheque confirmation system, ensuring added security and convenience. If a cheque is presented at another bank or brought by a bearer to a branch for withdrawal, users can confirm its authenticity through the app. This eliminates potential risks and enhances the trustworthiness of transactions.

Tax Certificate

This feature empowers users to generate and download account statements and essential tax-related certificates directly from the app. These certificates include Account Balance, Fixed Deposit Receipts (FDR), Deposit Pension Scheme (DPS), and Loan documents. By offering instant digital access to these critical financial documents, the app eliminates the need for manual requests and significantly improves customer convenience, particularly during tax preparation or financial planning.